The Resurgence of Cryptocurrency: Navigating Opportunities and Challenges in the Booming Market

The world of cryptocurrency has witnessed a significant resurgence, capturing the attention of investors globally. With Bitcoin soaring to new heights, exceeding the $69,000 mark previously set in late 2021, optimism in digital currency investments is at an all-time high.

The growing trend is evident, with over 40% of American adults investing in cryptocurrency. The global user base expanded to 580 million by the end of 2023, a 34% increase from the previous year, and is projected to reach nearly 800 million by the end of 2024.

Investors are diversifying their portfolios by including crypto assets like Bitcoin and NFTs to tap into the vast potential and innovation in the digital asset space.

However, delving into the cryptocurrency market poses its set of challenges, particularly due to the complexity of information and specific terminologies involved.

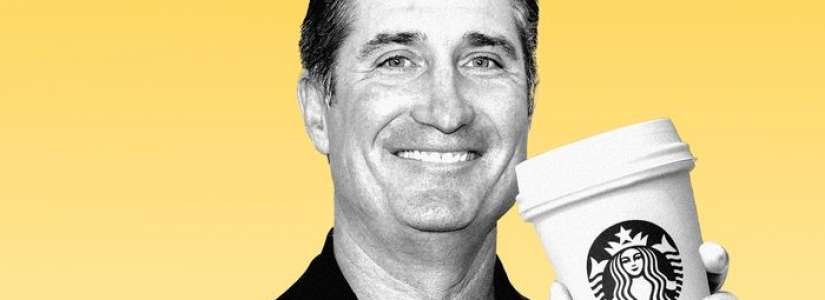

Ryan Lowman, CEO of Kenson Investments, highlighted the need for simplifying the investment process to accommodate everyone from high-net-worth individuals to the average investor, thereby minimizing financial risks associated with trial and error.

Understanding the Crypto Landscape

Cryptocurrencies and crypto tokens form the core of the digital asset environment.

Currencies like Bitcoin and Ethereum function as primary mediums of exchange within their blockchain networks, while tokens are developed for specific platforms or projects.

Altcoins, any cryptocurrency other than Bitcoin, alongside meme coins, stand out for their speculative nature, driven by internet trends and community support.

Regulatory Developments and Institutional Demand

The recent U.S. SEC endorsement of twelve Bitcoin ETFs and forthcoming Ethereum ETFs has significantly boosted the credibility and accessibility of these cryptocurrencies.

These regulatory advancements have sparked an explosive rally across the crypto universe, making investments more straightforward through ETFs.

Yet, venturing into altcoins and meme coins still involves navigating the complexities of crypto exchanges, wallets, and other technical aspects, which can be daunting for many.

Investment Challenges and Valuation in Cryptocurrency

Unlike traditional securities, cryptocurrencies present unique investment challenges. The lack of established valuation frameworks, detailed financial disclosures, and historical data renders the analysis and valuation of crypto assets more complex.

Their value often hinges on technological innovations, adoption rates, and market sentiment. Despite these challenges, the sector holds the promise of significant long-term returns, reminiscent of the early days of the internet.

Risks and Opportunities in Altcoins and Meme Coins

Investing in altcoins and meme coins comes with high volatility and regulatory uncertainties.

The potential for scams and fraud in loosely regulated environments underscores the importance of diligent research and risk assessment before investing.

A thorough evaluation of each cryptocurrency's inherent risks and distinctive features is crucial.

Analyzing Cryptocurrency Investments

The transparent nature of public blockchains offers a unique advantage in analyzing cryptocurrencies in real time.

By leveraging both qualitative and quantitative analysis, investors can gain insights into the potential of various cryptocurrencies.

This includes examining the credibility of the development team, the project's fundamentals, tokenomics, and market dynamics, as well as measurable metrics like Daily Active Users and Total Value Locked.

Related Read: Five Essential Financial Steps to Amp Up Your Stock Market Investments

A Strategic Approach to Crypto Investments

Kenson Investments exemplifies a strategic approach to investing in digital assets, emphasizing diversification and risk management. The firm tailors investment strategies to cater to the specific growth stages of assets, ensuring optimized returns and minimized risks.

Through regular updates and client education, Kenson Investments aims to empower clients with the knowledge to navigate the crypto market confidently.

In sum, the resurgence of cryptocurrency presents a landscape filled with opportunities and challenges. As the market continues to evolve, informed and strategic investments will be key to navigating this booming sector successfully.

Subscribe to our Weekly Newsletter for up-to-date articles and resources!