Housing Options on the Rise as Bonds Rally, Interest Rates Fall

The good news train keeps motoring on. Ten-year yield a truly lovely and low 3.82%. Vix mid teens. That print in the 60s a week ago was just that - a print. Thing are back to normal.

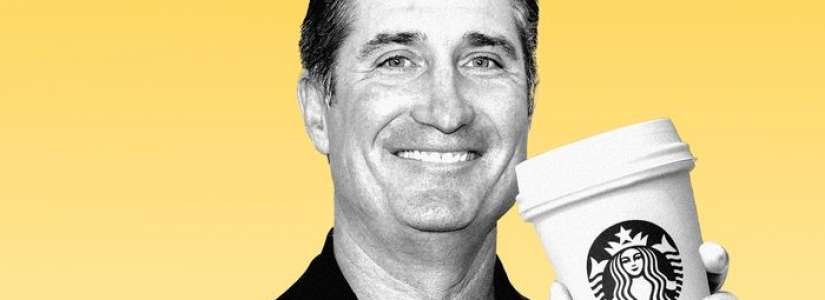

Markets are powerful. Look at Japan. They wanted to raise rates to defend their currency. Global investors handed their government and its assets and politicians a swift, decisive vote of no confdence. Game over. Their PM Kishida announced yesterday he wouldn't seek a second term. This recalls James Carville's line about wanting to be reincarnated as a "pope, president or .400 hitter in baseball". Because everyone fears the worldwide bond market. They do now in Japan, I will tell you.

Ichiro; take a bow.

Crypto is at the bottom of a medium-term bear run at the latter stages of a bull run in the early innings of a skyrocket higher all before crashing down to a penny (where I'm buying all of it). Who knows. Sometimes the cliches take on a life of their own and then the people writing stuff start believing what they say or think has any impact. To borrow a line from the former Treasury Secretary Robert Rubin on the whims and idiosyncracies of the dollar: "Bitcoin goes up; bitcoin goes down..."

The main thing we learned today in financial markets is inflation is cooler in the U.S. - the softest it's been since 2021 although it ain't dead yet. Lower CPI and PPI means cheaper money is coming and that's good for housing, gas prices, credit, hedge fund managers and students, among tens of millions of others. Take a big breath in. And relax.