Less Spinmeister; Watch the Tape Says Bond King Gundlach

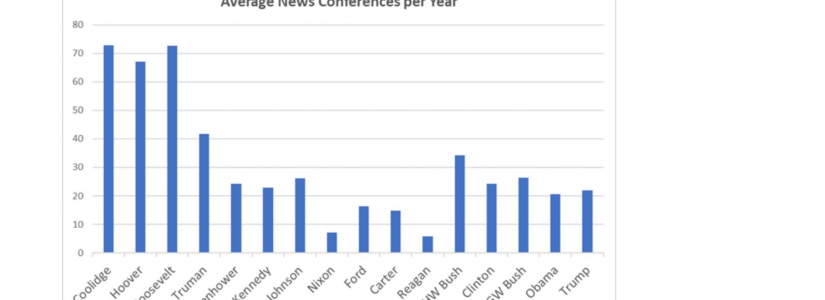

DoubleLine Founder Jeffrey Gundlach: "Ignore the spinmeisters; respect the bloodless verdict of the market. The announcement today, simultaneously proposing subsidies requiring more debt/money printing *and* price controls on food (soon to be other things), instantly propelled a huge rally in gold". Discuss.

There are so many talking heads in politics and markets. Few bear watching as closely as the great bond hedge fund manager Mr. Gundlach.

A couple points to consider. One, markets tend to ignore political-economic stump speeches as rhetoric; unless investors believe the outcome is preordained.

One candidate today espoused price controls on groceries and metals markets responded forcefully; another candidate declared "I'm a big fan of electricity". Those remarks didn't have an impact on commodity prices.

Candidly, you hear our nation's top bankers like Jamie Dimon and asset managers such as Larry Fink caution on America's runaway deficits and all you hear now from Washington is "Print, baby, print."

This could be a problem. Look at Japan. We're adding a trillion dollars to our liabilities every 120 days or so at present. The math on this very quickly gets kinda scary. Gold suddenly may be an alernative for some; bitcoin - with its infinitely fixed supply - could be, too.

Kamala Harris is moving markets. Donald Trump is not. The words and policies of each party and their representatives matter. Investors worldwide are paying close attention. Voters here might want to, as well.

A Buffalo Bills fan and one of the foremost authorities on Mondrian art, Jeffrey Gundlach is a pretty fair arbiter of things. He's vague at times who or what he is for. Maybe he's already announced the candidate he will support in November; I'm not entirely sure.

In the meantime, he is someone I find worth listening to. He drowns out the nonsense - and really shines a light on what's important. And how policies interplay with the economy.