Have Central Bankers Lost the Plot (Again)?

Pandemonium in financial markets suddenly as, more than anything, central bankers have lost control.

In Japan, a withering currency forced a real dilemma: how can the economy grow if the yen has no value? Solution: raise interest rates! Result: Japanese stocks fell in two days 13% - the worst rout since Black Monday in 1987. Man, that's so long ago even I wasn't trading back then.

In the United States, our Federal Reserve is simply behind the curve. They've waited too long to lower the cost of money. And now they're about to pay for that indecision.

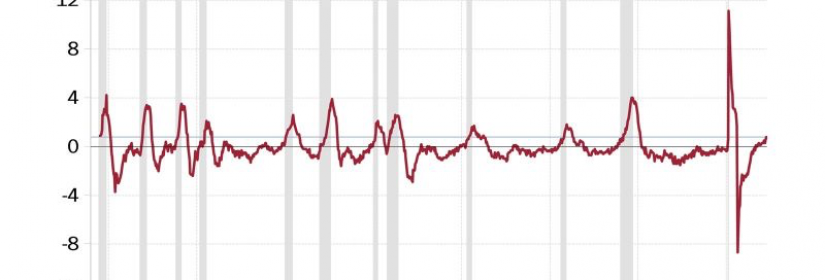

But don't take my word for it. Here's what veteran Wall Street economist David Rosenberg had to say on X: "The Sahm Rule triggered the recession call today. The chart here shows that the +80 bp jump in the jobless rate over the past year is a 100% iron clad indicator that the downturn has either arrived or is about to. The Fed is as behind the economic curve now as it was behind the inflation curve back in 2021-2022. Most of this tightening phase and cyclical bear market in bonds is set to unwind in dramatic fashion."

That darn Sahm Rule. Gets you every time.

What the heck does this all mean for me, Mike.

Well, if you own lots of stocks in your 301k, the value has almost assuredly gone down in the last 48 hours. But, hey, no biggie.

The "good" news is the cost of money is about to go way, way down. (Ten-year yield 3.82% last.) Which is a boon to people who have to find somewhere to live. I'm guessing food and energy expenses should also drop some in coming months - always a good thing. The dollar should soften, too, helping exporters here. See? Not too bad overall.

Now: about that recession.....